calculate the value of your business

Contact our team today for a free valuation!

Contact our team today for a free valuation!

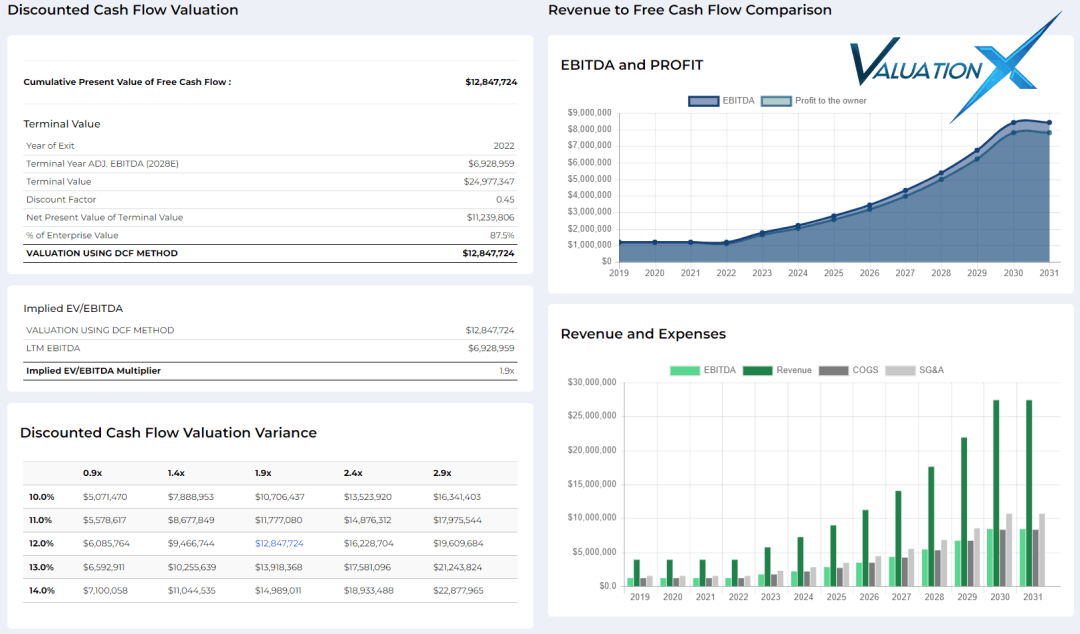

We use no fewer than five methodologies to determine how much your business is worth.

No valuation is complete without a plan of action. Our team will provide you with guidance on what you can do, right away, to boost the value of your business in the eyes of the market. Concrete, tangible steps that you can execute right away. This is available whether or not you choose to work with our firm on an exit event - all risk-free.

To demonstrate our negotiation prowess we will perform a cost-free analysis of your current environment, including data, voice, cloud, and managed services. Then, we propose a future state with an average of 20 - 40% cost savings, technology improvements, and consolidated billing. The only inputs we need from you are your existing contracts and most recent invoices. And yes, this is also included at no cost.

Qualified businesses are eligible to receive a free business valuation from Stone Peak. This assessment will be conducted using the five (5) methodologies listed above. Stop wondering what your company is worth - take action now to determine if now is the time to sell your company and achieve your financial goals. This offer is available for companies with $500K or more in annual revenue.

Did you know most owners leave hundreds of thousands of dollars, if not millions, on the table when they negotiate their own exit event? These situatons can be avoided by following a clear-cut process, but these steps must be taken prior to receiving a formal offer. This checklist is available for every company that receives a valuation.

No valuation is complete without a plan of action. Our team will provide you with guidance on what you can do, right away, to boost the value of your business in the eyes of the market. Concrete, tangible steps that you can execute right away. This is available whether or not you choose to work with our firm on an exit event - all risk-free.

To demonstrate our negotiation prowess we will perform a cost-free analysis of your current environment, including data, voice, cloud, and managed services. Then, we propose a future state with an average of 20 - 40% cost savings, technology improvements, and consolidated billing. The only inputs we need from you are your existing contracts and most recent invoices. And yes, this is also included at no cost.